In 2018-19 the average cost to resolve a thermal constraint in the GB power system was £109 / MWh. In 2022-23 it was £366 / MWh. The reason for the more than three fold rise? The increased cost of turning up gas power stations to replace curtailed renewable output.

It is widely accepted that our current approach to managing constraints needs reform. It consists of two formal mechanisms: investment in transmission network; and the use of the Balancing Mechanism (BM). In addition National Grid ESO carries out increasing amounts of ad-hoc energy trading in the hours leading up to gate closure.

Is that a sensible approach: two formal tools, one wielded 10 years or more ahead, the other from an hour before delivery, and nothing in between?

I was please to be asked to work with Scottish Renewables to explore the potential for a better approach. Today we have published a discussion report which suggests we should explore the development of a more sophisticated portfolio of tools.

Exec Summary: https://shorturl.at/fnwEF

Main Report: https://shorturl.at/dyMTV

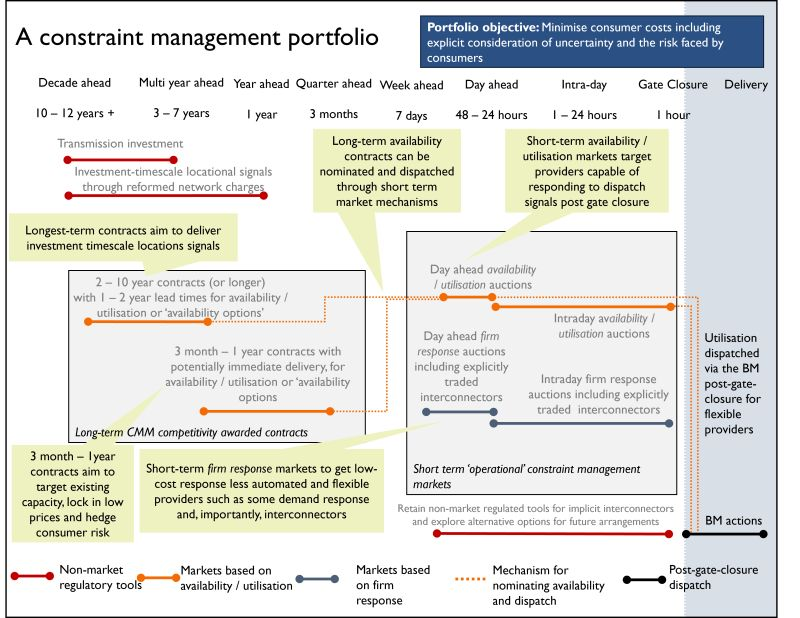

This would involve building a constraint management portfolio consisting of tools which could be used on a range of timescales as our forecasts of future constraints, and the uncertainty and risk associated with them, evolve. Such an approach would retain and improve transmission investment and the BM as the ‘bookends’ of the portfolio, with new tools such as constraint management markets adding books to the bookshelf. The result would be a tool kit with options for action on timescales of years, months, days and hours.

Suggestions that the report makes for developing the portfolio include:

🔸 Much better analysis of future constraint volumes and costs.

🔸 A clear objective for a constraint management portfolio based on maximising and protecting consumer value. This should include (a) reducing costs to consumers and (b) directly managing consumer risk.

🔸 The use of constraint management markets over different timescales to contract flexibility for constraint management lock in prices and hedge risk. This should include ….

🔸 …Long term constraint management markets with contracts on timescales of months and years, and…

🔸 ….Short term day-ahead and intraday constraint management auctions which formalise and build on the current ad-hoc energy trading that NGESO currently uses.

🔸 Transmission investment and the BM would remain the bookends of the portfolio with both processes being improved to reflect the net zero context.

🔸 There is a need to dig deeper into the role of interconnectors in causing constraints and their ability to help solve the problem. The report concludes there are opportunities to integrate interconnectors into a constraint management portfolio but that deeper engagement between market reform and the interconnector community is needed.